Tax Credit Project Details

Tax credit projects involve reviews of applications for state or federal tax credits for the rehabilitation of historic properties. Presently, applicants can submit commercial tax credit pre-applications through CRIS. Applicants for homeowner tax credit programs must send their applications directly to SHPO, rather than through CRIS. See SHPO’s Tax Credit Programs page for more information on these programs.

You can open the details module for a tax credit project in the following ways:

- Search for the project and click the View button for the project in the Results tab. You must have special privileges to search for tax credit projects. This functionality is generally only available to preservation personnel in state and federal agencies.

- Use the Find My Project form on the guest user Home page to search for the project.

- Find the project in the My Projects tab on your dashboard and click the View button.

- Open an Answer a Question page or consolidated response page pertaining to the project and click the View Project button.

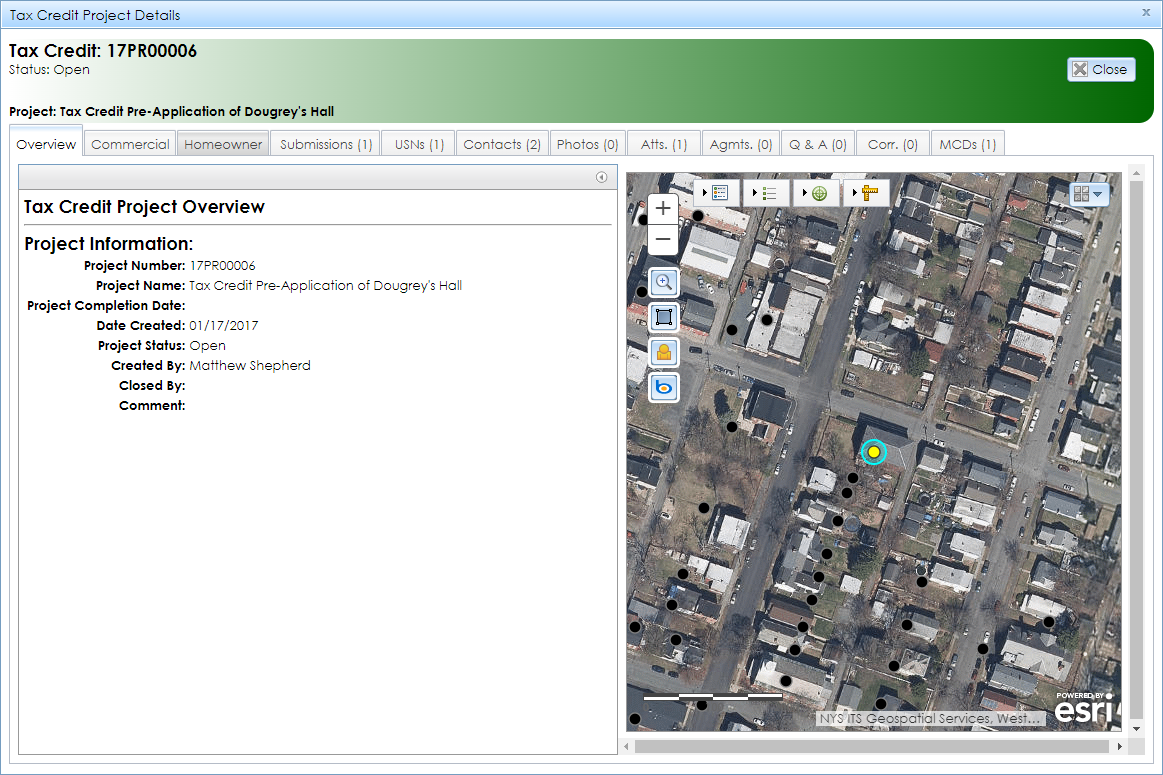

The Tax Credit Project Details module uses the same basic design as for other project types, with the addition of the Commercial and Homeowner tabs. When you open the module, it will display with the Overview tab open by default, as shown below.

-

Overview: Standard tab containing basic information about the project, as well as a map interface that zooms to the location of the subject property. The location point will be highlighted in light blue.

-

Project Information

- Project Number: SHPO’s project identifier in the format 16PR08851, where 16 is a 2-digit year (2016 in this example) and 08851 is a 5-digit sequence number.

- Project Name

- Project Completion Date: The date on which SHPO last closed the project. Tax credit projects are usually closed after SHPO issues its Certification of Completion in response to the Part 3 application.

- Date Created: The date on which SHPO accepted the project’s initial submission and created the project record in CRIS.

-

Project Status: The status of the project’s review.

- Open: The project is currently under review by SHPO.

- Closed: SHPO’s review of the project is complete.

- Re-opened: SHPO’s review of a previously closed project has resumed.

- Created By: The name of the SHPO reviewer who accepted the project’s initial submission and created the project record in CRIS.

- Closed By: The name of the SHPO reviewer who closed the project.

- Comment: A free-text field for miscellaneous comments about the project.

- Commercial: Contains a series of tabs pertaining to the Federal Investment Tax Credit Program for Income Producing Properties and the New York State Tax Credit Program for Income Producing Properties. If the property is not income-producing, this tab is disabled.

- Homeowner: Contains a series of tabs pertaining to the New York State Historic Homeownership Rehabilitation Tax Credit. If the property is not an owner-occupied residential building, this tab is disabled.

- Submissions: Standard tab containing a table of the project’s submissions, including the status, dates, and reviewers.

- USNs: Standard tab showing the USN that is linked to the project, as well as submitted resources that were included in project submissions. Click the View (magnifying glass) button to open a USN or submitted resource.

- Contacts: Standard tab showing a list of contacts who are linked to the project. This typically includes the property owner. Click the View (magnifying glass) button to open a contact record. If you are the project’s primary contact and an authenticated user, you may add a contact, edit an existing contact, or designate another contact as the primary contact.

- Photos: Standard tab showing photographs pertaining to the project. Photographs that are specific to built resources are typically included in the submitted resource and USN records, rather than in this tab. Click the View (magnifying glass) button to view or download the full-resolution image.

- Attachments (Atts.): Standard tab containing documentation pertaining to the project. Attachments for a tax credit project may include application forms and signoff letters. Click the download (green arrow) button to open or download each attachment.

- Agreements (Agmts.): Standard tab containing agreement documents between SHPO and other stakeholders. (This is typically used for consultation projects.)

- Q & A: Standard tab containing a table of SHPO questions pertaining to the project.

- Correspondence (Corr.): Standard tab with a table of correspondence records for the project.

- MCDs: Standard tab listing one or more counties and minor civil divisions (MCDs) in which the property is located. MCDs include cities, towns, villages, reservations, and boroughs.