Submit a Commercial Tax Credit Pre-application

The Commercial Tax Credit Pre-application Wizard allows you to submit information for an income-producing property that may be eligible for the federal and state commercial tax credit programs. Presently, applicants for homeowner tax credit programs must send their applications directly to SHPO, rather than through CRIS.

Commercial tax credit projects are reviewed by members of the Survey and National Register Unit (Part 1 of the application) and the Technical Assistance and Compliance Unit (Parts 2 and 3). Please visit SHPO’s Contact page for more information about these units and lists of specific reviewers.

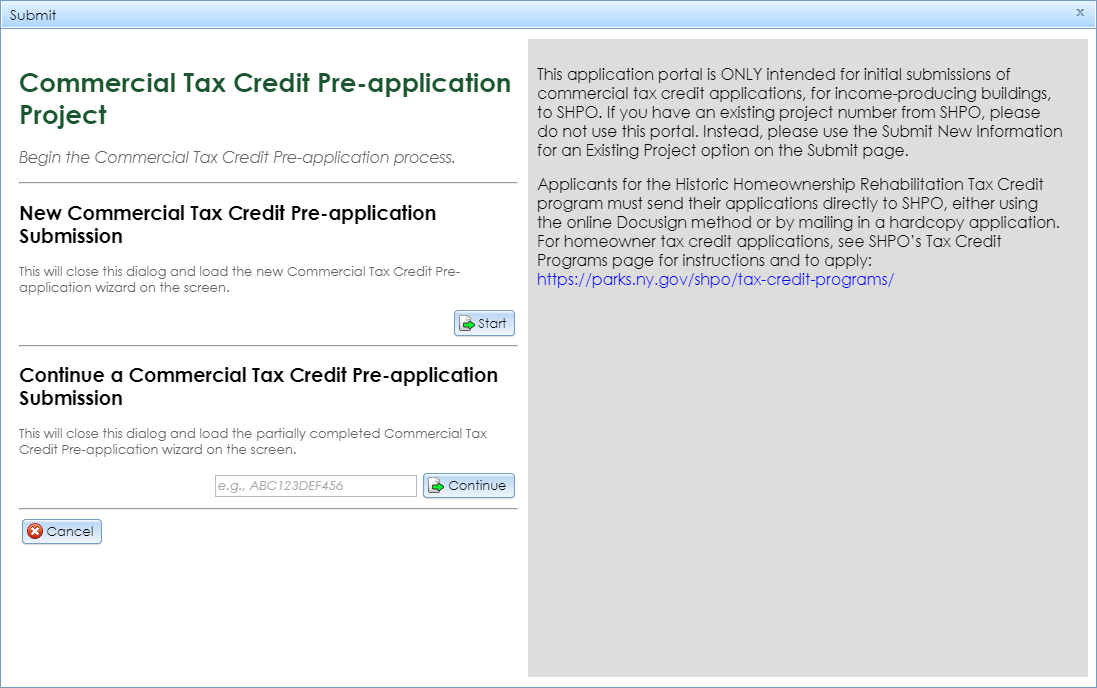

To begin a new commercial tax credit pre-application, click Submit in the top navigation bar to go to the Submit page. From the Submit menu, select the Commercial Tax Credit Pre-application option. A dialog window will open as shown below with the following menu options:

- New Commercial Tax Credit Pre-application Submission: Click the Start button to open the Commercial Tax Credit Pre-application Wizard.

- Continue a Commercial Tax Credit Pre-application Submission: If you are an authenticated user, you can reopen your submission from the My Submissions tab on your dashboard. If you are a guest user, copy the 12-character submission token from any of the email notifications you receive for this submission. Paste this token in the text box and click the Continue button to reopen your saved submission.

There are 5 steps in the Commercial Tax Credit Pre-application Wizard. For help with specific steps in the wizard, please click the links below.

- Contact Information: The primary and secondary contacts for the project. These contacts will receive email notifications about the project.

- Tax Credit Information: The tax credit program type (commercial) and the contact information for the owner(s) of the property. SHPO correspondence for this project will be sent to them and to the contacts from Step 1.

- Resource Information: Data about the property for which you are seeking a tax credit.

- Tax Credit Attachments: Attachments related to your pre-application.

- Summary: An overview of the submitted data. You can use this to review the submission before you send it to SHPO.