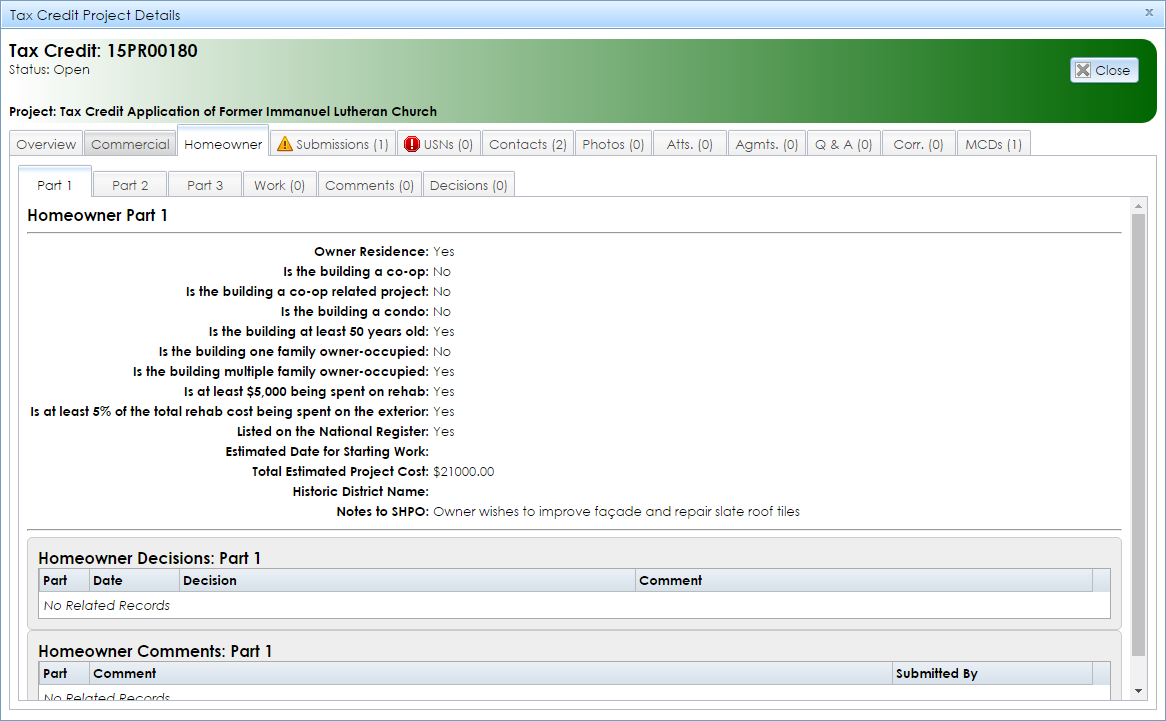

The Homeowner tab in the Tax Credit Project Details module contains a series of tabs related to the project’s application for state tax credits for residential properties.

-

Part 1: Part 1 of the tax credit application collects preliminary information about the property and results in SHPO’s certification of whether the property qualifies for the homeowner tax credit program.

- Owner Residence: Whether the property is owner-occupied. This is a requirement for the homeowner tax credit program.

- Is the building a co-op: Whether the property is part of a housing cooperative. Cooperatives may qualify for the tax credit.

- Is the building a co-op related project: Whether the project concerns only a single unit of a housing cooperative.

- Is the building a condo: Whether the property is a condominium. Condominiums may qualify for the tax credit.

- Is the building at least 50 years old: Whether the property was originally constructed 50 or more years before the time of the Part 1 application. Generally, buildings that are less than 50 years old will not be eligible for listing on the National Register of Historic Places, though there are exceptions. A building that is more than 50 years old may be eligible for listing if it meets the National Register Criteria for Evaluation.

- Is the building one family owner-occupied: Whether the property is a single-dwelling, owner-occupied residence.

- Is the building multiple family owner-occupied: Whether the property is a multiple-dwelling, owner-occupied residence.

- Is at least $5,000 being spent on rehab: Whether the proposed rehabilitation costs that qualify for the tax credit will total or exceed the minimum of $5,000.

- Is at least 5% of the total rehab cost being spent on the exterior: Whether the proposed exterior qualifying rehabilitation costs will total or exceed the minimum of 5% of the total proposed qualifying rehabilitation costs.

- Listed on the National Register: Whether the property is currently listed on the National Register of Historic Places. It must either be individually listed or be a contributing property in a listed historic district. To check a property’s contributing status, search for the district listing in the National Register criteria search tab, then open the National Register Project Details for the listing. The nomination form will be under the Attachments (Atts.) tab in the National Register project. You may also contact the appropriate reviewer from the Survey and National Register Unit, as listed on SHPO’s Contact page.

- Estimated Date for Starting Work: The date on which the proposed rehabilitation work will begin. The work proposed in the Part 2 application must be approved by SHPO before work can begin.

- Historic District Name: The name of the historic district that contains the property, if applicable.

- Notes to SHPO: Any comments to SHPO about the proposed rehabilitation or the reasons for applying for the tax credit.

- Homeowner Decisions: A grid listing SHPO’s decisions, including dates and comments, in reference to the Part 1 application. This will indicate whether SHPO determined that the building is a certified historic structure.

- Homeowner Comments: A grid listing SHPO comments pertaining to the Part 1 application.

-

Part 2: Part 2 of the tax credit application provides information about the proposed rehabilitation work. This results in SHPO’s determination of whether the proposed rehabilitation meets the New York State Standards for Rehabilitation.

- Is the household income under $60,000: Whether the household adjusted gross income is $60,000 or less for the year in which the tax credit is being claimed. If this is true, the Part 2 processing fee is waived.

- Total Estimated Project Cost: The approximate total cost of the proposed rehabilitation work.

- Part 2 Fee, Amount Paid: The amount in US dollars paid for the Part 2 processing fee.

- Part 2 Fee, Check Number: The check number for the processing fee.

- Part 2 Fee, Date on the Check: The date the processing fee check was signed or issued.

- Homeowner Decisions: A grid listing SHPO’s decisions, including dates and comments, in reference to the Part 2 application. This will indicate whether SHPO determined that the proposed rehabilitation meets the New York State Standards for Rehabilitation.

- Homeowner Comments: A grid listing SHPO comments pertaining to the Part 2 application.

-

Part 3: Part 3 of the tax credit application provides information about the completed rehabilitation work. This results in SHPO’s certification of whether the project is complete.

- Date Work Started: The date when the rehabilitation began.

- Date Work Ended: The date when the rehabilitation was complete.

- Total Final Project Cost: The total cost of the completed rehabilitation work.

- Part 3 Fee, Amount Paid: The amount in US dollars paid for the Part 3 processing fee.

- Part 3 Fee, Check Number: The check number for the processing fee.

- Part 3 Fee, Date on the Check: The date the processing fee check was signed or issued.

- Homeowner Decisions: A grid listing SHPO’s decisions, including dates and comments, in reference to the Part 3 application. This may include certification that the project is complete.

- Homeowner Comments: A grid listing SHPO comments pertaining to the Part 3 application.

-

Work: A grid listing each type of rehabilitation work in the project.

-

Info: A column with brief information about the work.

- Work Category: The type of rehabilitation work, such as Chimney Repointing, Heating System, or Roof Repair.

- Estimated Cost: The estimated cost of the specific proposed rehabilitation.

- Final Cost: The actual cost of the specific completed rehabilitation.

- Edited: Whether the work entry was edited.

- Date Last Edited: The most recent date on which the work entry was edited.

- Existing Condition: The state of the building element to be rehabilitated.

- Proposed Description: The proposed condition of the building element after rehabilitation.

- Completed Description: The actual condition of the building element after rehabilitation.

- Comment: Any notes relating to the work entry.

- Comments: A grid listing SHPO comments pertaining to all three parts of the homeowner tax credit application. These also display in the tab for each part listed above.

- Decisions: A grid listing SHPO decisions for all three parts of the homeowner tax credit application. These also display in the tab for each part listed above.