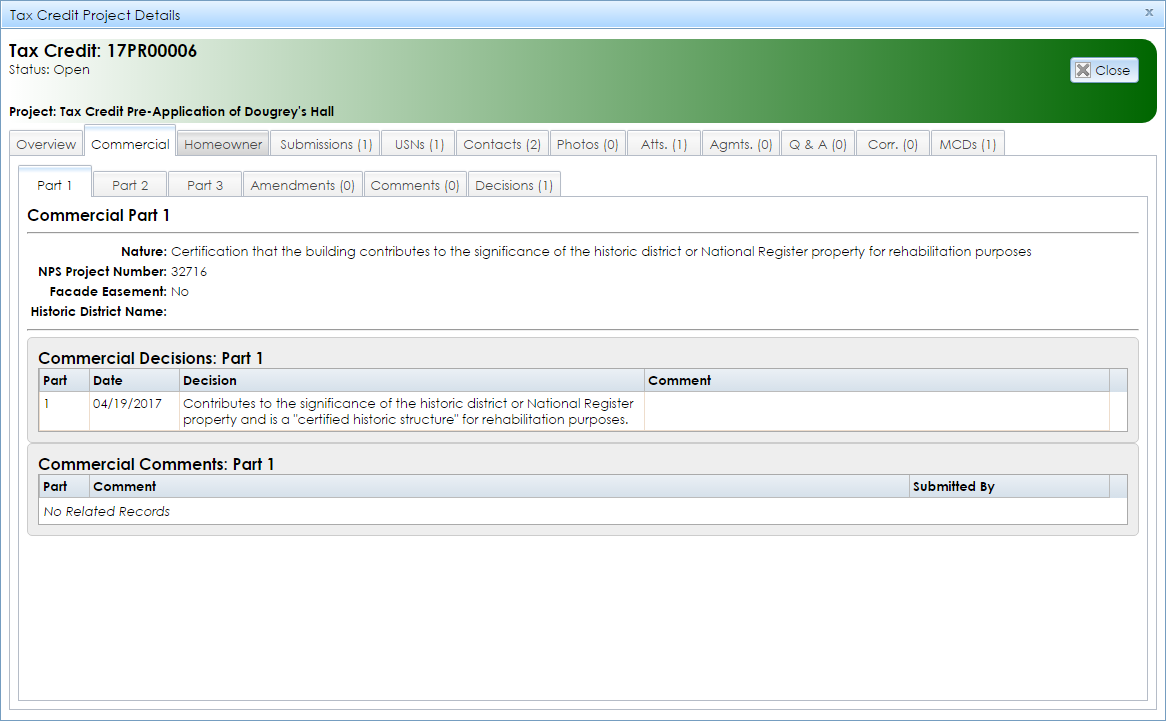

The Commercial tab in the Tax Credit Project Details module contains a series of tabs related to the project’s applications for federal and state tax credits for income-producing properties.

-

Part 1: Part 1 of the tax credit application (Evaluation of Significance) collects preliminary information about the property and results in the National Park Service’s certification of whether the property qualifies for the commercial tax credit program.

- Nature: The desired outcome of the Part 1 application. This may include certification that the property does or does not contribute to a historic district or National Register nomination, or a preliminary determination that the property is eligible for listing on the National Register.

- NPS Project Number: The National Park Service’s reference number for the application.

- Facade Easement: Whether the property has a façade easement. This is a legal agreement that places the property’s façade under the protection of an organization that agrees to preserve its historic fabric.

- Historic District Name: The name of the historic district in which the property resides, if applicable. The district may be listed on the National Register of Historic Places, a certified state or local district, or a potentially eligible district.

- Commercial Decisions: A grid listing the National Park Service’s decisions, including dates and comments, in reference to the Part 1 application. This may include certification that the building is a certified historic structure or that it meets the National Register Criteria for Evaluation.

- Commercial Comments: A grid listing SHPO comments pertaining to the Part 1 application. This may include notes on when documentation was sent to the National Park Service.

-

Part 2: Part 2 of the tax credit application (Description of Rehabilitation) provides information about the proposed rehabilitation work. This results in the National Park Service’s preliminary determination of whether the proposed rehabilitation meets the Secretary of the Interior’s Standards for Rehabilitation.

- Estimated Date for Starting Work: The approximate date when the proposed rehabilitation will begin.

- Estimated Date for Work Completion: The approximate date when the proposed rehabilitation will be complete.

- Number of Phases: The number of discrete phases in which the rehabilitation will proceed.

- Estimated Rehab Cost: The approximate total cost of the proposed rehabilitation expenses that qualify for the tax credit.

- Floor Area SqFt Before Rehab: The property’s existing square footage before the proposed rehabilitation.

- Floor Area SqFt After Rehab: The property’s square footage after the proposed rehabilitation.

- Uses Before: The property’s use before the proposed rehabilitation.

- Uses After: The property’s proposed use after rehabilitation.

- Number of Housing Units Before Rehab: The number of housing units in the property before the proposed rehabilitation.

- Number of Housing Units After Rehab: The proposed number of housing units after rehabilitation.

- Number of Low to Moderate Income Housing Units Before Rehab: The number of low- to moderate-income housing units before the proposed rehabilitation.

- Number of Low to Moderate Income Housing Units After Rehab: The proposed number of low- to moderate-income housing units after rehabilitation. This number may figure into additional tax credit programs.

- Part 2 State Fee, Amount Paid: The amount in US dollars paid for the Part 2 processing fee.

- Part 2 State Fee, Check Number: The check number for the processing fee.

- Part 2 State Fee, Date on the Check: The date the processing fee check was signed or issued.

- Commercial Decisions: A grid listing the National Park Service’s decisions, including dates and comments, in reference to the Part 2 application. This may include preliminary determination that the proposed rehabilitation meets the Secretary of the Interior’s Standards for Rehabilitation.

- Commercial Comments: A grid listing SHPO comments pertaining to the Part 2 application. This may include notes on when documentation was sent to the National Park Service.

-

Part 3: Part 3 of the tax credit application (Request for Certification of Completed Work) provides information about the completed rehabilitation work. This results in the National Park Service’s certification of whether the proposed rehabilitation meets the Secretary of the Interior’s Standards for Rehabilitation.

- Date Work Started: The date when the rehabilitation began.

- Date Work Ended: The date when the rehabilitation was complete.

- Estimated Rehab Cost: The approximate total cost of the rehabilitation work that qualified for the tax credit.

- Total Estimated Project Cost: The approximate total cost of the rehabilitation, including qualifying and non-qualifying expenses.

- Number of Housing Units Before Rehab: The number of housing units in the property before rehabilitation began.

- Number of Housing Units After Rehab: The new number of housing units after rehabilitation was complete.

- Number of Low to Moderate Income Housing Units Before Rehab: The number of low- to moderate-income housing units before the rehabilitation.

- Number of Low to Moderate Income Housing Units After Rehab: The number of low- to moderate-income housing units after the rehabilitation. This number may figure into additional tax credit programs.

- Part 3 State Fee, Amount Paid: The amount in US dollars paid for the Part 3 processing fee.

- Part 3 State Fee, Check Number: The check number for the processing fee.

- Part 3 State Fee, Date on the Check: The date the processing fee check was signed or issued.

- Commercial Decisions: A grid listing the National Park Service’s decisions, including dates and comments, in reference to the Part 3 application. This may include certification that the completed rehabilitation meets the Secretary of the Interior’s Standards for Rehabilitation.

- Commercial Comments: A grid listing SHPO comments pertaining to the Part 3 application. This may include notes on when documentation was sent to the National Park Service.

-

Amendments: If a commercial tax credit application is updated after it is submitted to SHPO or the National Park Service, the amendment is recorded in a grid under this tab.

-

Info: A column detailing the type of information being updated in the amendment.

- Includes NPS Info: Whether the amendment includes additional information requested by the National Park Service for an application that is on hold.

- Updates Contact Info: Whether the amendment updates an applicant’s or contact’s information.

- Edited: Whether the amendment record has been edited.

- Date Last Edited: The most recent date on which the amendment record was edited.

- Amends: A column noting which part of the application was amended (Part 1, Part 2, or Part 3).

-

Advisory: This column indicates whether the amendment is a request for an advisory determination that a particular phase of the rehabilitation project meets the Secretary of the Interior’s Standards for Rehabilitation.

- Request Phase: The number of the project phase being considered.

- Request Total Phase: The total number of project phases.

- Request Date End Phase: The completion date of the project phase being considered.

- Description: A summary of the amendment.

- Comments: A grid listing SHPO’s comments pertaining to all three parts of the commercial tax credit application. These also display in the tab for each part listed above.

- Decisions: A grid listing the National Park Service’s decisions for all three parts of the commercial tax credit application. These also display in the tab for each part listed above.