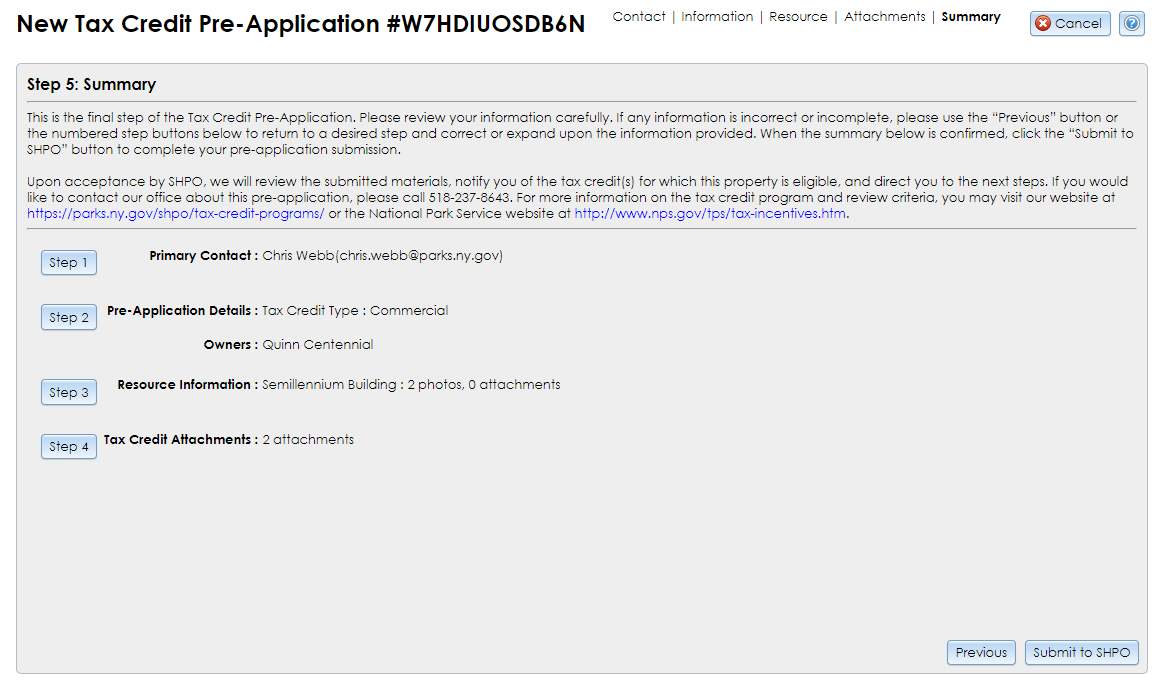

The final step of the Commercial Tax Credit Pre-application Wizard presents a summary of your commercial tax credit submission, including the following information:

If you need to return to an earlier step, click the button that corresponds to it on the left. After completing that step, click the Next button to proceed through the remaining steps and return to Step 5.

If you need to exit the Commercial Tax Credit Pre-application Wizard at this point, click the Cancel button in the upper right corner. An alert will pop up: Are you sure you want to cancel this Submission?

Click OK to exit the wizard. Your submission changes will be saved.

When you are ready to send your submission to SHPO, click the Submit to SHPO button in the lower right corner to send the submission to SHPO’s processing queue. A thank-you message will pop up in CRIS and an “Initial Submission Received” email will be sent to the contacts you entered at Step 1 as well as any owners with email addresses enter at Step 2. If you are an authenticated user, the submission will appear in the My Completed Submissions view of the My Submissions tab on your dashboard.

If SHPO needs more information or revisions before they will accept your submission, they will send an “Initial Submission Found Insufficient” email to the submission’s contacts. This email will include SHPO’s comments on what needs to be changed or added.

If you are an authenticated user, you may edit the submission by going to the My Submissions tab on your dashboard and clicking the Edit (pencil) button for the submission. If you are a guest user, you may go to the Submit page to reopen your saved submission.

Please note that if you edit a submission, it will be removed from SHPO’s processing queue until you resend it to SHPO. If you resend the submission to SHPO, its Date Received will reset to the current date. If you wish to view the submission’s contents without making changes, use the View an In-Progress Initial Submission option on the Submit page.

When SHPO accepts your submission, an “Initial Submission Accepted” email will be sent to the project contacts and the submission will be given a Project (PR) Number and entered in CRIS as a new tax credit project record. If you are an authenticated user, the project will appear under the My Projects tab on your dashboard, from which you may open the project details.

After SHPO reviews your initial submission, you can submit further documentation to the project using the Submit New Information for an Existing Project form. This will attach your documentation to the same project.